Find the Right Medicare Plan for You – Local, Trusted Help.

We help you compare Medicare Advantage, Supplements, and Prescription Drug Plans in minutes.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

🟩 What Is Medicare?

Medicare is a federally funded health insurance program primarily for people age 65 and older. It also covers certain younger individuals with qualifying disabilities or End-Stage Renal Disease (ESRD). The program is divided into four main parts, each covering specific types of healthcare services.

✅ Who Qualifies for Medicare?

Adults 65 years or older

Automatically enrolled in Part A and Part B if receiving Social Security.

People under 65 with certain disabilities

Eligible after receiving Social Security Disability benefits for 24 months.

Individuals with End-Stage Renal Disease (ESRD)

Eligible at any age with permanent kidney failure requiring dialysis or transplant.

📘 The 4 Parts of Medicare

Part A – Hospital Insurance

What it covers:

Inpatient hospital care

Skilled nursing facility care (short-term)

Hospice care

Limited home health care

Cost:

Usually free if you or your spouse paid Medicare taxes for at least 10 years.

If not, premiums can apply.

Part B – Medical Insurance

What it covers:

Doctor visits and outpatient care

Preventive services (like screenings and vaccines)

Lab tests, durable medical equipment

Mental health services

Cost:

Monthly premium required (standard amount in 2025 is ~$202.90, varies by income)

Typically 80/20 cost-sharing: Medicare pays 80%, you pay 20% (after deductible)

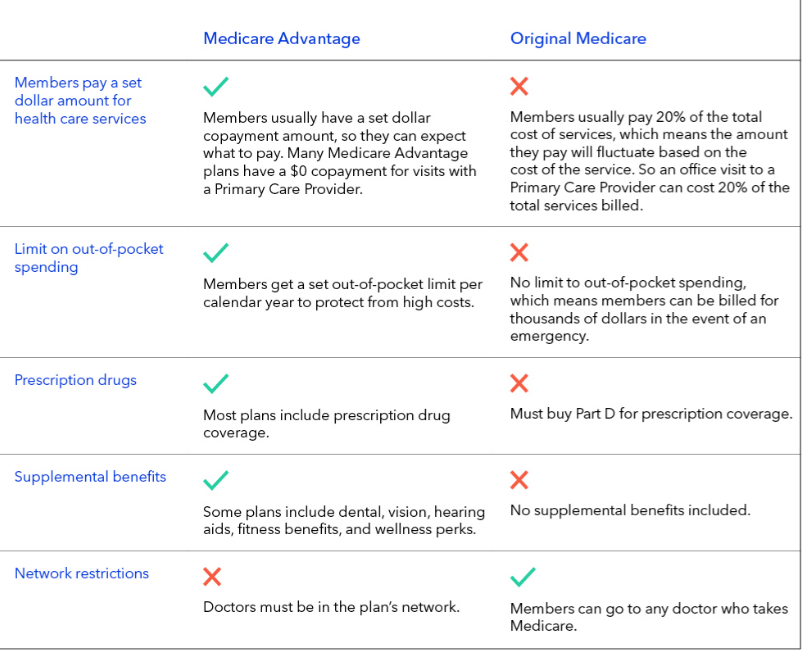

Part C – Medicare Advantage

What it is:

Private insurance plans approved by Medicare that bundle Part A, Part B, and usually Part D (drugs)

Often includes extra benefits like vision, dental, hearing, fitness, and over-the-counter allowances

Important Notes:

Must continue to pay your Part B premium

Plans may have low or $0 monthly premiums, but copays, coinsurance, and out-of-pocket limits apply

Network restrictions: You often need to see doctors within the plan’s network

Part D – Prescription Drug Coverage

What it covers:

Helps cover the cost of prescription medications

Offered by private insurers approved by Medicare

Coverage tiers vary, affecting copays for generics vs. brand-name drugs

Penalty alert:

If you delay enrollment and don’t have creditable drug coverage, a lifetime penalty may be added to your premium

Bonus: Medicare Supplement Insurance (Medigap)

Medigap policies help pay for some of the costs that Original Medicare (Part A and B) doesn’t cover, such as:

Deductibles

Copayments

Coinsurance

These are stand-alone policies sold by private insurance companies.

You must be enrolled in Original Medicare (Parts A & B) to purchase Medigap — not compatible with Medicare Advantage.

Pro Tip for Clients:

“If you want maximum freedom to choose your doctors, a Medicare Supplement may be ideal. If you prefer a bundled, all-in-one option with low premiums, a Medicare Advantage Plan may suit your needs — especially if you’re healthy and don’t travel often.”